The AltKuz FlexCap Derivative Strategy : A Superior Alternative to the Net Zero!

The AltKuz FlexCap Derivative Strategy :

A Superior Alternative to the Net Zero!

Copyright File: 28679/2023-CO/L

Prasad G. Rao, MTech, PhD PennState

Director,

AltKuznets Sustainability Advisors

director@altkuzadvisors.com

COP may come and COP may go, but

Climate Change, or more precisely, the Climate Crisis, is here to stay ….. and

worsen! We have tried ‘em all – Fuel Quota, Carbon Taxes, Carbon Permits, NDCs,

and yet all that we may credibly claim as success is Renewable Technology. And

that too, at a scale and a pace that doesn’t shrink the price of Electricity! It is inane school math that enlarging the

Renewable Market Share of an expanding Economic Pie yet permits of increments

to Fossil Fuel Sales, EPS and PE! And those, in turn, imply continuing Fossil

fuel Investments in Drilling, Refining, Transportation and ICE Vehicles – investments

that portend a continuation of current trends and exacerbation of natural

disasters and imperilment of Public Life & Lifestyle. Left unresolved, the current

economic paradigm is likely to bring about a CO2-exacerbated world that merely

accommodated Renewables to the extend compatible with the intents of Nominal

paradigm and Capital market Investors. A mid-way compromise between Renewables

& Fossil fuels might solve Politics, but the Climate would continue to

suffer a tailspin and cause globally-distributed Natural catastrophes and Human

devastation.

AltKuznets, headed by a PennState PhD-embellished Director with a Thesis in Energy, Env. & Mineral Economics, has a vantage, pole position in understanding the dynamics underlying the Climate Crisis. AltKuznets understands why Resource-endowed nations and Precincts turn Climate laggards, how investments in Exploration & Refining are tied politically in to the distant future, how important Transportation is to an economy, how Fossil fuel consumption correlates to slow-moving changes to Automobile Fuel & Efficiency characteristics, why Investors are wary of a heavy-handed policy in the markets, how the pace of Renewables expansion within a constrained or constrained global Carbon Space affects GHG emissions, and how Majority Politics & Democracy threaten any enduring solution. Realizing the global nature of the Carbon Crisis, the multiple Resource-endowed parties, and how laissez faire market pricing works to attenuate pro-active environmental policies, AltKuznets suggests a Capital market-leveraged Financial strategy that combined the authority of a Climate Bond, with the power of the Derivative market to obtain a globally-enforced, yet flexible resolution to the Climate Crisis that encompassed its major stakeholders – Fossil Fuels Entities, Equity & Bullion Investors, Renewables, Multi-modal Transportation Fleet Owners and Users, and Insurance entities.

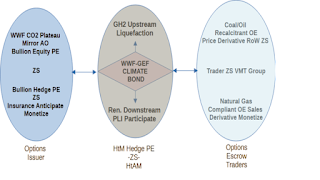

We envisage the Climate Bond to leverage a synergy between the Bullion, Renewables firms & Insurance entities to administer the Derivative Strategy in a compact with the Bullion and the Insurance Coterie. The strategy leverages the Hold of the Commons-Climate Bond on global Capital Markets to have the Bullion Hedge issue CO2 Plateau Derivatives to the Climate Bond on the schizophrenic Compliant-Recalcitrant OE (Natural Gas-AO ZS-Oil). Derivatives would be benchmarked to Climate-Bond determined upper limit on Fossil Fuel Quantities and Trader-sensed lower limit on Fuel prices. The Climate Bond would hold Fossil Fuel Sales, Price & Quantity ‘Interest-Cycle’-dovetailed ‘Hold-to-Maturity’, HtM Derivatives, and leverage Derivative Market strategies to bifurcate them in to ‘Hold-to-Almost-Maturity’, HtAM Price & Volume Derivatives. It’d, thereafter, leverage its Derivative Trader Group, DTG, to price and trade those Derivatives globally. The DTG would price those HtAM Derivatives by market trends that it sensed from its association with a multi-modal VMT Group, MMVMT, that were aligned OC to the Climate Bond. The MMVMT Group would, jointly with the WWF-Climate Bond-GEF and the Bullion Hedge, would administer an Annual VMT-optimization strategy that incentivized Public/Group- & Green VMTs, and otherwise penalized personal and Fossil-fuel VMTs.

Derivatives would be evaluated for deviations at expiration, exceeding which would force cyclic ‘WWF OE-monetized’ Derivative Payoffs significantly larger than Refiner Sales-realized Profits & PE. Our Strategy envisages applying these Derivative Payoffs between Upstream Renewables (Bio-ethanol, Conventional Solar, Agro-Voltaics)), and Downstream Renewables entities (Green Hydrogen, EVs). Such cyclic payoffs would incentivize those Renewables to expand Capacity and increment their Market Shares against Fossil Fuels, even as Natural Gas Assets were PE-protected, and Oil, the Recalcitrant OE suffered a Sales, EPS & PE Loss. Whereas the Climate Bond (& its Renewables Coterie) would benefit from Derivative exceedances as compensated by Recalcitrant OE, the Insurance, facilitated by a Natural Gas Narnia ZS Mirror, would claim a Mirror Anticipate Monetize with each expiration of Plateau Derivatives above the Bond-evaluated Sustainable CO2 Concentration. Our Derivatives Strategy permits the Recalcitrant OE to pre-emptively buy away Hold-to-Almost Maturity, HtAM Derivatives to claim a ‘Volatility Pound Cake’ on the Derivative Cycle. Derivatives would be cyclically re-issued with updates to CO2 Plateau, Reserves, Sales, Prices & Quantities, thus ensuring a repetitive ‘Incentive-ZS-Discincentive’ that so dramatically re-structured the economics of holding Oil & Gas Assets, Production, Refining and Marketing, that the Oil Sector instead preferred to dovetail with, and partnered the Climate Bond in the implementation of the ’AltKuznets Axial-cum-Derivative Strategy’ toward achieving Climate Sustainability.

These Benchmarks & Limits pertain,

in the case of the Carbon Plateau Derivatives, to the Terminal Time, T, projected

equilibrium CO2 Concentrations, and in the case of Fossil Fuel Sales, to Price

& Quantity Limits as evaluated by the Climate Bond toward eventual Climate

Sustainability. Fossil Fuel Refiners would, consequent the associated repeated

and exponential Derivative payoff due deviation from Derivative Benchmarks,

adopt strategies that conformed with Climate Sustainability intents of the

Climate Bond. Our Strategy optionally leverages Optimal Control to determine

the optimal path of (Bond-enforced) CO2 concentration toward the Plateau

Benchmark, thus dovetailing the entire financial construct with Climate

Sustainability.

The Strategy forces a schism between Climate-exacerbating Oil and Climate-moderating Natural Gas Assets by super-imposing two mutually-exclusive entities at the Bullion Hedge. These Bullion Hedge-registered entities would track Reserves, Production, and Sales as well as use of shared Capital & other Assets with virtual, 2-part Long-Short ‘Hedge Shares’ – Asset Shares & Marketing Shares issued those Oil & Gas Firms. The creation and issue of firm-specific 2-part Hedge Shares by the Bullion Hedge facilitates schizophrenic participation of Fossil fuel firms holding common Oil & Gas Reserves, joint Production & Storage and Marketing facilities in our Derivative Strategy. These Shares constitute the basis on which Derivative Payoffs are computed. They facilitate the stabilization of Equity market PE – an explicitly intended benefit exclusively offered Natural Gas Asset-firms by the Climate Bond. The CO2 Plateau-linked shadow values of Natural Gas Hedge Asset Shares & the Derivative-Payoff linked shadow values of Hedge Market Shares would, jointly, determine the PE of the virtual Natural Gas firm (listed as an Oil & Gas Firm)[1].

Though our Derivative Strategy is

reducing of Oil, it offers an Axial escape to Owners of Oil Reserves as

copyrighted in our supplemental Design[2]. Our

Axial Design claims to leverage Planetary Finance & NFTs to offer an Axial

resolution to Climate-stranded Oil reserves that take the form of a compromised

issue of Space Dollars to its Owner. Thus, and between the Climate Bond-Plateau-exceedance

Incentives issued Renewables, PE Stabilization of Natural Gas Firms &

Assets, Derivative-incentivized & multi-modal VMT optimized dovetailing of

Fossil fuel consumption with Climate Sustainability, Market compromises issued Oil,

and Axial resolution offered disadvantaged Oil Assets, AltKuznets claims to

have a holistic resolution to both Climate Sustainability, and Oil & Gas

Assets & Market valuations.

AltKuznets has staked a MNC-sized

Market-Regulatory-cum-Derivatives firm to implement and administer this strategy.

It welcomes interests, particularly from Multi-lateral Institutions such as the UNFCCC, the WB-SDG, IFC-Climate Coalition, GEF and other international environmental coalitions, as well as

large IT & Finance firms toward realizing this over-arching global

objective.

[1]

Thus, the Hedge PE for an Oil

& Gas Firm at the Bullion Hedge would comprise two parts – a shadow Hedge

PE for Oil that dropped precipitously, and a Shadow Hedge PE for Gas that

stabilized with participation in the Climate Bond. The composite Hedge PE would

relate to the relative number and shadow values of Hedge Asset & Hedge

Market Shares.

[2]

‘The AltKuznets Fintech Axial Solution to

Climate-Stranded Fossil Fuel Reserves’, Copyright File: 24795/2023-CO/L,

AltKuznets Sustainability Advisors, altkuznetsadvisors.com

Comments

Post a Comment

Email us at director@altkuznetsadvisors.com