THE ALTKUZNETS ‘GST BOOST’ TO SUSTAINABILITY

Prasad Rao, PhD Director

INTRODUCTION

The advent of internet, digital financial instruments and

online trading platforms has opened a large set of opportunities and issues. Specifically,

the rapid & unregulated growth of the online consumer economy, that

incremented environmental externalities associated with production, packaging,

transportation, consumption and disposal, has remained largely unregulated.

This owes to the fact the online platform is an assemblage of many producers,

many Retailers, and many consumers, each who are diffusely distributed over a

large aerial extent, consequent to which there is both a diffused remote

violator and a free rider problem. As trade links deepen and incomes expand,

such consumerism is likely to expand, and exacerbate multi-media pollution. It,

hence, turns necessary to conceive of a strategy that not only encompasses the enormity

of the digital world, but also addresses the complexity from the diffused

nature of the problem.

THE

ONLINE GST OPPORTUNITY

Much as the global internet marketplace and online shopping has turned a nightmare, the same also constitutes an opportunity when it is governed by an uniform tax paradigm. The GST regime represent a globally-valid strategy to compute and levy taxes and tax refunds across various categories of producers and manufacturers. Applicable in principle to all goods and services traded on the online marketplace, the GST regime operates federally with cognizance of economic activity aggregated from Precincts or States within. Thus, the GST regime effectively covers 100% of online Business & Household shopping – whether on Private one to one basis, or thru a public online Marketplace. Such coverage constitutes a Policy & Biz Opportunity that could be leveraged to design an environmentally-efficient, commercial strategy.

‘ONLINE

EXTERNALITIES’ & THE ‘AQP’

STRATEGY

AltKuznets anticipates the innumerable externalities associated with goods and services traded at the online marketplace. These externalities encompass the entire land, water bodies, their estuaries and deltas, ocean routes, local and regional atmospheric pollution. They extend across Primary & Secondary Sectors, Durables Manufacturing & Consumables producing firms, and generate multi-media pollution that escape the cognizance of the marketplace due the anonymity and distributed nature of the online marketplace populated by large number of suppliers and consumers. Externalities generate at various stages of the Product LifeCycle: Raw material supply, Transport, Storage, Manufacturing or Refining, Packaging, Waste generation in Consumption & post-Consumption disposal. It is verily impossible to apportion such a temporally, contextually and spatially-diverse set of Externalities to particular instances of sales of goods or services between two entities connected by an online marketplace. Instead, AltKuznets adopts an ‘Affine-Quasi-Parallel’, AQP, strategy that is Divisia-advantaged for its comprehensiveness and coverage of Externalities across stages of production and consumption, time, or media, and which beyond charging environmental culpability, also engenders incentives appropriate to the larger Sustainability context. Our strategy applies across the various Life Cycle Stages of Sourcing, Manufacturing, Transportation, Consumption, Recycling and Disposal subject to the transaction being GST-recorded. By design, the AQP strategy obtains Incentives & Outcomes that are equivalent on an aggregate to those that obtain with trade-specific externality valuation & policy intervention.

CONSTITUTING

GSTI, THE SUSTAINABILITY INTERMEDIATOR

It is necessary, to facilitate the strategy and obtain concentrated incentives, to conceive of an Intermediating firm between Principals/Producers/Manufacturers/Retailers & Buyers/Clients. AltKuznets conceives of a ‘SDRE Bond AO OC Green Bond’-sponsored GST Intermediating Firm, the GSTI, that maximized its long- and short-run Profits by co-opting the SDRE Bond and market-listed Green Bonds in securing its objectives, and by mediating GST Rebates to members participating publicly or privately in Environmental remediation.

As conceived, the GSTI would

undertake an intermediary role between Producers, Manufacturers & Retailers

on one hand, and Buyers on the other. We conceive the GSTI as representing a

very large group of Household and Business Buyers and Sellers to a Green

Bond-represented SDRE[1] Bond. The

GSTI would capture and record both online trades in Public marketplace, and voluntarily-participated

offline trades between Private entities. Acting on behalf the many Producers

and Manufacturers, and the innumerable Buyers, the GSTI would enforce Membership

requirements on both. It is in this role that it’d adopt a two-pronged

strategy. It’d, on one hand, recommend a restricted list of Sustainability-imbued

Products across all residential, commercial and industrial sector, and on the

other, offer various mandatory & voluntary Climate, Primary Volume

Hedge/Recycling/Secondary Production & Environmental Sustainability

programs to its upstream Supplier and downstream Buyer members. These programs,

when purchased, would help attenuate multi-media pollution attributable to both

Producers and Consumers, and cover local, ambient and immediate, as well as

global, diffuse and distant externalities.

WHATZ

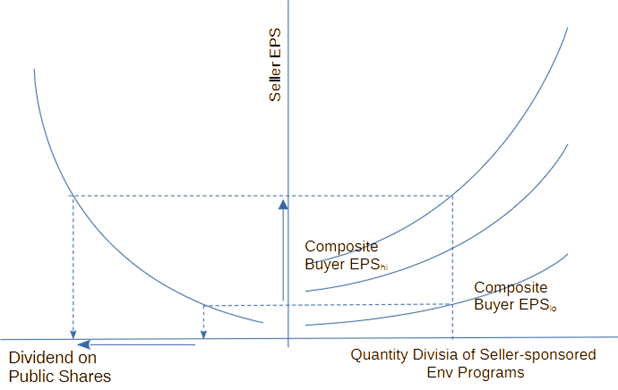

MY SUSTAINABILITY SCORE? THE EPS !

The computation of Buyer-

or Seller-specific Environmental Participation Score, EPS, that proxies for Externality

fees & charges post computation of Product- & Transaction-specific obtains

from a complex computation that tracks Mandatory or Voluntary Participation, Sales

to and Purchases from various Household and Business entities. Our computation

of the EPS cumulates across trades and updates annually. Members with high EPS

would qualify for GSTA-sourced Rebates at a higher Dividend rate than other

less-committed Members. The GSTI would accumulate GSTA-issued rebates across

purchases the B2B & B2C trades of various affiliations, and preferentially re-allocate

them as Dividends and Rebates or Vouchers to qualifying Sellers and Buyers by

their EPS in a manner that rewarded participation in Sustainability

initiatives, and sharpened Sustainability incentives while ensuring intended Design

Outcomes were achieved.

SHARES? PUBLIC &

PRIVATE?

The GSTI require Buyers

and Sellers to subscribe to its Circular Economy requirements by subscribing

to, or purchasing from its basket of Environmental Certificates & programs[2] as

suggested by the GSTI. In return, it’d issue Buyer & Seller Firms as well

as Households with GSTI Public (Equity) Shares

in proportion annual subscription to Green Programs & Sales volume on

platform, and in inverse proportion Taxes paid by its Consumers above the Floor

rates. GSTI Private (Preference) Shares would

be issued the Sponsors – SDRE Bond Cause Members and Sponsors of Market-traded Green

Bonds in direct proportion their participation in the respective Bonds. Whereas Public Shares would be eligible for GST Rebates re-apportioned & distributed as Dividends by EPS Rank, both listed Businesses holding EPS-tagged Public Shares & Private Shareholders may leverage the imbued Sustainability FV at the Bullion Hedge.

PROGRAM

ADVANTAGES & RECAP

Our Design is

embellished with several unique features and advantages. The market-based

design is voluntary and incentivized with rebates and associated financial

incentives. It is comprehensive in its coverage of goods and services traded by

Households and Businesses in both B2B and B2C modes. Built around cumulative

statistics, it is incentivizing of long-run participation. It offers members

the flexibility to participate Public or Private, and either limit their

participation to the Mandatory, or engage further with Voluntary participation

beyond local boundaries. Further, our Design is unique for inter-linking the

computation of Seller and Buyer EPS, thus inducing Buyers and Sellers to

upgrade to Sustainability in their sales and purchases. Thus, our design is

incentivizing of long-run commitment to environmental sustainability. In

addition, GSTI Member participation in voluntary environmental remediation

program increments their EPS that the Bullion Hedge PE section of the market

could take cognizance of in revising the Firm’s Hedge Floor PE upwards.

Our design, on account the GSTI acting on behalf innumerable Buyers and Sellers as well as accepting bids from multiple providers of environmental services, is characterized by Efficiency, Economies of Scale and Scope that augur well for its environmental and economic success. The availability of numerous Recycling and Renewable Certificates options toward EPS accretion, combined with the facility to adopt environmental remediation programs as offered by many entities across geographies, obtains a globally-interlinked, efficient, fast-forwarded and quantum increment to Sustainability that is verifiable in indices.

AltKuznets asserts its design is unique for its foresight and leverage of various economic and environmental nuances, and that its design, implemented in cooperation with the GSTA, would obtain significant Environmental Benefits while largely retaining Revenue Neutrality. AltKuznets further claims that its design offers an integrated strategy for Buyers and Sellers across Government, Business and Household categories. It is incentivizing of across-the-board Sustainability increments amenable to leveraging at the SDR Long FX

AltKuznets stakes a global Market-Regulatory Firm that’d additionally offer Consulting Service to globally-networked, but nation-specific GSTI branches. It invites Business Interests, subject to Terms & Conditions posted at its website, in implementing this proposal globally.

Comments

Post a Comment

Email us at director@altkuznetsadvisors.com