Inequity-Corruption-Inefficiency Nokeynomics !

Inequity-Corruption-Inefficiency Nokeynomics !

Ganga Prasad Rao

gprasadrao@hotmail.com

Disclaimer: The author does not vouch for the purported outcomes of the design proposed herein under. Actual outcomes could vary due economic and financial market dynamics. (Errors, Omissions and Death threats excepted !!!)

Introduction

Inequity? Corruption? Inefficiency? Social and Environmental unsustainability? So what's new in the nominal economy? These are age-old malaise, much as are Vice and Slavery. To root them out would be denying human greed, -sensitivities, -errors, and indeed, human urges that incentivize our actions (and inactions!). But should we condemn ourselves to these excesses and tolerate them as they pervade our public space and private life, erode our constitutional rights and personal freedom? Shall we, (un)like the proverbial followers of Moses walk across the dry bed of the River Jordan and seek a miraculous change of heart in our political masters residing in the mountainous headwaters? Or, attune ourselves to the times, align with the madness we call political euphoria, and congratulate ourselves for joining the crowd of self-deceivers and participate in ‘The Grand Nominal Lie’? And if the answer to these questions is a resounding No, then where lies our salvation? Or, more to the point, How?

Here, I present the outlines of a sophisticated, albeit an elaborate global strategy built around the creation of Sustainability-, Innovation- and Scale-capital from expressly-designed 'CompCoins'/'Futcoins' derived from index-driven, Enhanced Closed-cycle, ECC Cause Bonds and their post-processing at the IMF and World Bank. The design provides an ingenious means to recover socio-economic issues, motivate the generation of apposite capital, and invest the same to alleviate those issues. By compensating, on one hand, victims of the nominal economy with ‘CompCoins’, and funding remedial reforms and innovation on the other, the proposed design brings about an endogenously-controlled, market-driven, international monetary-cum-national fiscal system. The proposed design offers monetary support for the ECC Cause Bonds that explicitly target social malaise, compensates victims of corruption and unsustainability, and offers growth opportunities to the economy. The scheme is global in scope and offers a means to incentivize nations to innovate, and adopt equitable and efficient policies as appropriate to the preferences of its people. It is also consistent with the existing global monetary system and with national fiscal policies.

The 'Motivating Model'

God deigned there be two genders, male and female, two color extremes, black and white, two moral states: good and bad..... and two polar economic paradigms: Real and Nominal! For our purposes, lets define the 'Real' as an efficiency-maximizing, FV-oriented, production- & investment-intensive and an innovation-seeking economy. The Real economy targets maximum efficiency, adopts new technologies rapidly, and offers market-determined employment opportunities unmindful of innovation-related labor impacts. In contrast, the PV-oriented Nominal economy is one that appeases various political, social and economic interests. Adopting ex-ante a cyclical GDP macro-strategy, and despite the resulting environmental degradation, it accommodates inefficiency in production and services and stock-market speculatory greed to support labor demand. Implicit to this nominal paradigm is the political manipulation of the pace of innovation and technology adoption. Such accommodation opens the door to inequity, inefficiency and corruption. Between the polar extremes of the 'idealistic real' economy and the 'expedient nominal' stands the Aural economy, the Global Sustainability benchmark, and a sponsor of the gold-based 'mediating-monetary system'. Sponsors of this system seek societies that expand sustainably - a sustainable compromise between the two polar paradigms across the various social dimensions and macro-economic phases.

If the gulf between the real and the nominal economies originates in inequity, inefficiency, and public ESH externalities - all of which are impacted by policy-inefficiency and political - misgovernance, aka, Corruption, and by the mis-timing of innovations and their adoption, ie, political accommodation of obsolescence, the same may be leveraged to design index-driven, ‘Enhanced Closed Cycle, ECC Cause bonds’. In the context of a PV-focussed nominal economy, consider Closed-cycle Bonds that espouse the idealistic cause of maximal production efficiency within a closed material- and product cycle that does not release waste to the environment whether in production, transport, consumption or disposal. While these CC bonds recognise waste discharges due production inefficiency, their diligence does not extend to Environmental Safety and Health (ESH), or for that matter, equity issues such as Corruption in political governance, or political judgements concerning the rate of technology adoption. It is therefore opportune, in the context of the Real-Nominal divide that is motivated by larger societal issues, to modify CC Bonds and include ESH-, Innovation- and Equity-related impacts as well - their inclusion further extending the scope and duration of the Bonds, (now mimicking Global Sustainability Cause bonds) and the exactitude of its goals. Thus, each Nation's ECC Bonds represents and fills the gulf between its nominal and the real economies, and may validly claim, if indirectly, to capture ESH-, Corruption and Innovation-related inefficiency as well. They are, in a sense, societal debt bonds that turn assets upon achievement of the Cause.

An ECC Bond may be thought of as the equivalent of a promised Forward contract on a distant 'SGDP FV Society'. Sponsored jointly by the Nation's Sovereign Fund with an 'SGDP Oo' and with a ‘CC 2’ by the FII Consortium, and meant to be the national counterpart to Global Sustainability bonds, they are issued upon formula-driven, multi-tiered, nested divisia-indices of the underlying determinants. The Divisia-construct increments for production-, transport-, consumption-, and disposal- efficiency, ESH-sustainability, equity improvements and technological advances, but shrinks to reveal the impact of inefficiency, ESH-deficiencies, inequity-enlarging Corruption and the political accommodation of obsolescence. The resultant index value correlates directly with ‘Design NAV’ around which the ECC Bonds are traded. ECC Cause Bonds have a design terminal value pegged to 100% efficiency, zero inequity and zero corruption - an idealistic benchmark unlikely to be met over the Bond term. They are issued by a Government authority, such as the Planning Commission, to a select group of Sustainability Believers-Sustainability Judges, (SB-SJ), and Cause Participants-Expert Investors, (CP-EI), who are offered an 'SGDP/CC Judge Group Oo Share' for holding the Bonds and overseeing the achievement of its goals.

The definition of the closed-cycle 'fundamental evils' is critical to the design of ECC Bonds. They should, at the same time, be well-defined, globally-consistent, comprehensive and naturally-bounded quantitative, relative- or ratio-measures, yet rely on publicly-sourced, verifiable data and measures. These data would then combine through nested, multi-tiered variables in to Divisia indices that peg the 'Design NAV' appropriate to the current level of the evils. A nested, multi-tiered design permits the consideration of a large number of even minor factors that aggregate in to variables comprising the upper tiers that explicitly quantify the Design NAV. (The market NAV would reflect expectational/anticipatory volatility and other supply and demand considerations that disperse the actual NAV around its design value). In other words, the NAV of the ECC Bonds, whose maximum is limited by the utopian, if unachievable world of total efficiency and equity, rises from its issue price to a value-band that brackets the intrinsic index-driven value indicated by the Divisia formula underlying the ECC bonds.

The three scourges - Inequity, Corruption, and Inefficiency - themselves Divisia-indices of components, and which together determine the Design NAV of ECC Bonds, must yet be weighed in to the index driving the NAV of ECC Bonds. While one could attach weights arbitrarily, the same could be recovered from an econometric estimation. That estimation, exploiting time-series data on the various determinants of Real GDP net of imputed ESH Damages - Technology, Resource Endowment, Infrastructure investment, Education, Political system, and indeed, Inequity, Corruption, and Inefficiency - and exploiting flexible functional forms, would yield, upon estimation and further derivations, expressions that reveal the partial impact of the various determinants, including the three scourges, on Real GDP. These, upon further manipulation, would yield elasticities that likely serve as an excellent set of weights to attach to the index that drives the ECC Bonds.

Thus designed, the ECC Bonds serve to quantify the country-specific efficiency, equity and sustainability impacts triggered by, and prevalent in the expedient, nominal economy within the larger context of global sustainability.

Complementary (and Supplementary) Coins

The ECC Bonds, being 'SGDP Oo Innovation Ookey'-embodied Cause-bonds to begin with, do not lend themselves to active trading, and in any case, may not be denominated to facilitate widespread holding among Investors and Consumers. In such instances, one could resort to issuing Coins upon the asset or debt and permit market uncertainties and expectations to price them. Coins represent the divided FV, divided and discounted PV NAV of the expected terminal value, ETV, of the underlying untraded asset (or debt) whose current value varies consistent with its intrinsic valuation, as well as supply & demand factors including market-related expectations. Given both ETV and discount rates vary across time periods, Coins issued on assets rise with higher ETV and lower discount rate, and fall in value in periods of lower ETV and higher discount rates.

Given a Cause Bond issued at NAVto with an idealistic Design Terminal Value at time T, DTVT, that currently trading at NAVt1, one could decompose the ‘DTVT-NAVt1 net’ in to ‘Comp(lementary)Coins’, representing the anticipated eventual shortfall relative to DTV, DTVT-EATVT, and ‘Supplementary Coins’, representing the anticipated gain over NAVt, EATVT-NAVt. A 'CompCoin' may be conceived of as the current divided market valuation of the expected net between the theoretical maximum of index-driven ECC Bonds, DTVT, and its Expected Actual Terminal Value, Et[DTVT] (=EATVT) at the end of the term. Put another way, Complement Coins represent the current (discounted) expectation of the future net between the DTVT and the EATVT; its traded value varies as much with expectations around that net in each period as it does with discount rate and market-related speculative factors. The value of these ‘deficit coins’ represents the extent to which ECC Bonds are expected to fall short of their DTV, and hence offer a probabilistic peep in to the attainability of the cause underlying their issue. CompCoins increase in value as the 'expected sustainability shortfall' increases with an expansion of inequity, corruption and inefficiency and fall when the ECC Bonds increment in value to indicate progress toward the SGDP goal. For any given net, they expand when the discount rates falls, reflecting a heightened concern for the future, and vice versa. (Compcoins, because they permit trading gains upon anticipated deficits, trigger ‘Cause Obligations’ that force the pace toward achievement of the Bond Cause). Thus designed, Compcoins also permit the elicitation of perceptions of transitory or permanent impact of current policies. Should current unsustainable policies be perceived to hurt the society in the long-run also, the EATV of the ECC Bond tranche falls and Compcoins rise in NAV. Should current unsustainable policies be presumed transitory, reversible or easily recovered from, the Bond EATV holds close to DTV, and Compcoins show little change in price. Unlike CompCoins that reveal the expected shortfall in achieving the Cause, Supplementary Coins embody expected gain to maturity due expansion of the EATV, or contraction of the current NAVt, or both. Their value is likely to correlate negatively with that of CompCoins. CompCoins and Supplementary Coins, together substitute for the original bond, and hence obviate trading in Bond units.

The FII-PC (Macro-prudential) Tango !

Now consider an FII that nominally or otherwise positions itself in the opposite of the ECC Bond issuer, here the Planning Commission. Post the issue of ECC Bonds and its assignment to 'Sustainability Believers-Cause Judges-Cause Participants-Expert Investors’ (SB:SJ:CP:EI), the FII, in competition with other FIIs, awaits an opportune time to buy out an entire tranche of ECC Bonds, ie, the transfer of the EATV corpus of a particular tranche of ECC Bonds against a post-dated P-Note that it offers to the Planning Commission, and which serves as a conditional post-dated 'Bonus' for the transfer of rights to the Bond issue and its EATV corpus.

(Issued at the bottom of the rate cycle, but without fresh liquidity, by a National planning authority, the ECC Cause Bonds achieve their purpose of reducing inefficiency and corruption in the economy by (also) turning investment-capital and working-capital costly in an environment of rising interest rates. Should inefficiency and corruption enlarge despite the rate hikes that accompany a resurgent nominal economy and cause the index-driven NAV of the ECC Bonds to fall sufficiently for the FII to evince interest and buy away the corpus, the Planning Commission recommends the issue of fresh liquidity underwritten by an 'SGDP Enemy Opposite 2 Share' fund line, equal the value of the current Bond corpus against the post-dated FII P-Note, while the FII contributes a Dollar-denominated 'Friend Apposite Innovation Oo Share' line of liquidity to the Equity market in amount equal the decrement to Bond corpus relative to its issue size. These fresh infusions of liquidity are best applied to raising the index-driven NAV by achieving the goals of the ECC Bond. Such opportunities occur when ECC Bonds are traded at NAVs significantly in excess of their intrinsic, formula-driven value.)

(In turn, Gold-based monetization - the issue of Cause-based incremental liquidity, M2dot, either as IMF-sponsored Sustainability Gold ETFs, or WB CC-Innovation Dollars upon physical gold submitted toward, and held in lien for the monetization - creates fresh capital that furthers the cause of the Real economy – appropriate for a society that has a natural proclivity to lurch toward a nominal, even an unsustainable economy. The monetization involves varying the ratio of Gold ETFs issued against physical Gold with the measured severity or significance of the Cause (as registered via the Ballot/Referendums/Surveys or other information/opportunity-imbued instruments such as Compcoins) through a novel financial construct, the 'Futcoin delta' that, in turn, derives from Futcoins, an FV unit of NAV linked to index-driven Global Cause Bonds. The more significant the Cause, the larger is the Sustainability- or Innovation-deficit/opportunity, the larger is the Futcoin delta associated with the instrument, and the more Sustainability/Innovation capital it deserves. A Gold-based, Cause-dependent monetization, tied to the magnitude of 'Futcoin Delta' for calibration, ensures the supply of Sustainability- and Innovation capital in the right amounts.........

The FII post-dated P-Notes offered to the Planning Commission are themselves sourced from an 'Unsustainability Mirror-Incremental Multiple-EO Round' from a future series of FII-sponsored gold-monetization at the IMF/WB, and expressly intend to resolve current unsustainability in the nation, reflected in ECC Bonds and Compcoins, against anticipated unsustainability elsewhere in the group of gold-monetizing nations.

This exchange of the Bond EATV corpus against the post-dated P-notes leaves untouched the Bond units assigned to the SB:SJ:CP:EI, who turn de-facto 'FII Cause Judges'. Cause Judges monitor FII diligences, including their political conduct, during the course of the bond duration. By their pronouncements and market moves, they signal and determine the pace of progress in the Bond Cause. They also have a final say in the export of Compcoins toward use in Gold monetization at the IMF/WB.

To compensate the FII for Bond units that continue to be in possession of the SB:SJ:CP:EI despite the transfer of the negotiated terminal bond corpus, the Bond issuer, here, the Planning Commission, offers a 'Bond Corpus Mirror-FV Hedge' in the form of a contingent Sovereign Promisory to the FII. The 'Bond Corpus Mirror-SGDP Friend Key 2 Share' Sovereign Promisory, in turn, serves as an 'FV-Hedge-Collateral' that the FII leverages to issue CompCoins upon its expectation of Bond EATV. The FII, which invalidates trading in the Bond tranche when it creates Compcoins in the magnitude Et1[DTVT-EATVT], hedges by issuing Supplementary Coins equal Et1[EATVT-NAVt1] to ‘SB:SJ:CP:EI’. Since different FIIs operating in a particular nation may have different expectations on different tranches of the same Bond issue, ie, different EATVs, their Compcoins and Supplementary Coins too would be valued differently despite benchmarking them to a common ECC Bond-pricing formula.

Should the ECC Bond substantially achieve the DTV near the terminal date, the FII deems it a success. CompCoins fall in value to (near) zero even as the NAV of Supplementary coin enlarge to their maximum. The FII returns the Sovereign Promisory back to the Bond-issuer (informally legitimising the encashment of the P-note), buys in to the ‘SB:SJ:CP:EI’ and the untradeable Bond units, thus and in effect, limiting its take to the terminal value of Supplementary Coins net of P-note value (plus the gains from investing the ‘Innovation Oo Share’ line in the Equity market) when the Bonds are finally discharged in its favor. In such cases, the CompCoins, with residual unsustainability, serve to justify rather than minimise unsustainability in gold monetization. However, should the ECC Bonds significantly underperform the DTV (and EATV at ownership transfer), the FII rejects the ECC Bonds, jettisons the SB:SJ:CP:EI, triggers the Sovereign Promisory that invalidates the P-Note issued to the Planning Commission, and banks the CompCoin (& Supplementary Coin) End value on terminal date or earlier, along with Equity market returns to the Innovation line. It ships the cancelled CompCoins (imbued with a 'Sustainability Ookey Innovation 2 Opportunity') to the IMF/WB where their use in Gold monetization rounds creates 'SGDP Oo Innovation 2'-seeking capital (the 'Unsustainability Mirror-Incremental Multiple-EO Round' in which validates a future P-note transaction on a different ECC Bond tranche).

FutCoins and the FutCoin Delta

Futcoins are ‘FV-Asset coins’ that represent expected terminal value of comprehensively-defined, index-driven, untraded Sustainability Mirror Bonds upon which they are issued (its discounted PV analogue would be a ‘Debt Coin’ with an attached ‘Cause Obligation key’). Sustainability (Mirror) Bonds represent the virtualization of a global aggregate of National ECC Bonds. They provide a means, at the ‘What-if Futcoin’ rounds at the IMF/WB, to evaluate country-specific or context-specific sustainability deficiencies (that are, by implication, sustainability opportunities) by indicating the potential gain in Sustainability measured as the gain in Futcoin value (the Futcoin Delta) upon their remediation.

Compcoin Assignment: Nominal Regime-Real Compensation !

FIIs, for whom cancelled Compcoins represent the raw material for creating fresh sustainability and innovation capital, place them in such Consumers and Businesses who are both impacted by, and representative of the sustainability and innovation deficits they seek to document at the IMF/WB gold-monetization rounds to obtain a large Futcoin-delta and thus endow themselves with large amounts of fresh capital. The Compcoin assignee-domain is a strategic FII choice and permits them to differentiate themselves from competing FIIs. Thus, each FII distributes a large number of small-denomination ConsumerCoins and an equal amount of larger-denomination BizCoins - among those likely to deviate from ECC Bond goals - impenured or lower-middle class Households, and Producers of essential goods, labor-intensive firms and firms dogged by capital constraints or other instances of perceived/anticipated policy-injustice, inefficiency or unsustainability. These deviations from sustainability are recorded in to the Attribute vector of (cancelled) Compcoins and interpreted in the ‘What-if’ Futcoin rounds at the IMF/WB to obtain the magnitude of the Futcoin Delta, that, in turn, calibrates the gold-monetization multiple. The search for Futcoin-delta, then, is equivalent to a search either for widely prevalent or concentrated inequities and inefficiencies in the society. This design, by incentivizing FIIs with Futcoin delta-linked capital, induces them to search out the nooks and corners of our social structure to identify potential sustainability and efficiency gain opportunities, thus and eventually, furthering the vision of a larger, inclusive, equitable, more environmentally sustainable, and incrementally efficient society.

Compcoins represent incremental disposable income to FII-favored Consumers and unbudgeted liquidity/incremental working capital to FII-chosen firms. While Consumers may apply the income gain to essentials/consumables, or to seek durable loans, firms apply the incremental liquidity toward wages, raw material bills or to seek investment capital. In this manner, FIIs ensure that a fall in social equity or efficiency, or a rise in corruption that enriches the already aggrandized, is balanced by appropriate compensations to the group of ConsumerCoin and Bizcoin assignees.

By falling in value as the economy turns sustainable and rising when unsustainable, Complement coins reveal to the Planning Commission and the FIIs the state of the economy, and force upon Compcoin assignees an ethical dilemma - revealing by their actions the extent of ESH-excesses, inequity, inefficiency and corruption they would tolerate or react to, and thus offering the FIIs a reliable measures of WTPs and WTAs. Assignees who choose to redeem Complement Coins when priced high to buy in to Consumables and Durables implicitly accept the unsustainability that drove up the worth of their coins. In contrast, assignees who hold Complement Coins, or buy in to them in such periods demonstrate a willingness to take losses and ensure a return to the path to SGDP. If CompCoins were distributed free and broadly among citizens by FIIs of various hues and niches, their purchases and redemptions would reflect societal values toward efficiency-compatible, long-term sustainability and equity-enhancing short-term lifestyle excesses.

Primary and Secondary Coin Markets

CompCoins and Supplementary coins are issued by various FIIs on different tranches of ECC Bonds. Since these coins are created on different expectations of equity, efficiency and innovation outcomes in the distant future (and indeed, different EATVs and terminal dates), it’d be expedient to exchange and trade them in a common market place. Given ECC Bonds are decomposed to CompCoins and Supplementary coins, it’d be appropriate to separate their trading by the same logic in to Primary and Secondary markets. The Primary market serves to facilitate the SB:SJ and CP:EI to trade in Supplementary Coins – a market that CompCoin assignees are excluded from. Responding to socio-economic events, they take opposing positions and trade to either signal the fast-forwarding of the Bond agenda by going long on Supplementary Coins when they perceive a rapid deterioration of the state of the society, or, permit 'nominal latitude' of a particular kind by shorting Supplementary Coins issued by specific FIIs that buys political breathing room in difficult economic times. The Planning Commission, with oversight on the Primary market, takes cue from the behaviour of the SB:SJ:CP:EI, to re-allocate and re-prioritize various equity and efficiency programs under its governance.

The Secondary Complement Coin market operates parallely and independently of the ECC Bond market under the aegis of the FII consortium. Exchange in the Secondary market occurs between suppliers of Cancelled CompCoins (Grocers and Consumer Cooperatives, FMCG/Retail/Service Industry), Cancelled BizCoins (Labor unions, Raw material suppliers and Intermediate-goods suppliers) and buyers of Cancelled CompCoins (Trade Associations, FIIs) and Cancelled Bizcoins (Consumer Cooperatives/Retail Banks, FIIs). The Secondary Complement Coin market facilitates market participants to trade in both, cancelled ConsumerCoins and cancelled Bizcoins to each other toward their search for low-cost loans/capital, and in the case of FIIs, toward the stringing of CompCoin fractals for monetization at the IMF/WB. The Secondary market is populated by ConsumerCoin and BizCoin assignees. FII-participation in the Secondary market is mutually beneficial – it obtains them Cancelled CompCoins necessary for fractal-based gold-monetization, and simultaneously assures Cancelled Compcoin-holders of compensation, even a premium, for the discount issued on their wares sold to Consumers and Manufacturers.

The FIIs, who monitor the trades in the Secondary market, perceive a sustained increase in Compcoin prices as evidence of overt unsustainability, and an opportunity to claim sustainability- and innovation-capital from the IMF/WB, and expand their footprint in the domestic economy. Anticipating such opportunities, they actively seek Cancelled Compcoins that they could leverage at Gold-monetization rounds abroad to obtain incremental, low-priced capital for Sustainability/Innovation-enhancing investments. In reaction, the SB:SJ buy Supplementary coins in the Primary market, and signal a tightening of their ESH, Efficiency and Ethical standards. The consequent expansion of the gap between the implicit market-traded value and the index-determined value of the ECC Bonds, triggers a fast-forwarding of ECC Bond goal-compliant activities which the Planning Commission supports with an SGDP 2.

MatchCoins

The FII CompCoin assignees - impenured, lower middle-class families, and labor/raw-material-intensive and capital-constrained firms - have a choice in the use of CompCoins (ConsumerCoins and BizCoins) assigned to them. Households, or Consumer groups, may choose to apply them as variable Discount coins toward purchase of Consumables at the exchange rate prevalent in the Secondary market. However, should Consumer (-Cooperatives and Retail Banks) seek funds for lower-priced durable loans, they must buy cancelled (post-use) BizCoins spent on wages or raw material bills (from labor unions and producers of raw materials/commodities/intermediate products) to pair their uncancelled Consumercoins toward a loan requisition to the FII. Firms too may apply BizCoins toward working capital, pay wage bills and raw material input costs, or buy cancelled ConsumerCoins (for instance, from Grocers) to pair with uncancelled BizCoins and seek lower-priced investment capital from the FII. The very market that facilitates trade in uncancelled Compcoins also permits such matching of cancelled, but unmatched ConsumerCoins and BizCoins to their uncancelled counterparts across the Household/Consumer - Business/Manufacturer divide (Uncancelled coins may be pooled with Consumer Cooperatives and Trade Associations, but not traded between assignees).

The logic underlying the generation of paired Compcoins, ie, Matchcoins, is that they are imbued with information on preferences, constraints and choices from both sides of the Household/Consumer – Business/Manufacturer divide – information crucial to FIIs, and policy-makers at the WB/IMF in their resource-generation, policy-design and resource-allocation decisions. Post securing sufficient Matchcoins, Households (or, Consumer Groups) and Producers seek loans and funds by staking their matched coins with the FII. These match coins are imbued with both producer and consumer information that FIIs find useful to ascertain opportunities, expectations, perceptions and reactions among Consumers and Business, and indeed, the state of the economy. MatchCoins represent a synergy of unmet consumer demand and producer opportunities that have been denied due high cost of capital prevalent in, and symptomatic of an inefficient and corrupt domestic economy. They are indicative of hitherto undiscovered equity- and efficiency-deficits that point to an immediate Manufacturing/EO opportunity to advance sustainability (if with low-cost of capital FII resources). MatchCoins, embodied with 'Equity deficit-cum-Efficiency-opportunity', are therefore prized at the Gold-monetization rounds abroad, not only on risk and information grounds, but also for the low-risk investment-window they open to apply the freshly-created, lower-priced CC-Scale capital.

CompCoins are, in a sense, quality-differentiated for being possessed of multiple attributes. These attributes derive from the sector/sub-group to which they are assigned, the problem they seek to uncover and highlight, and indeed, the salient reactions of the assignees. These attributes, much as attributes of an equity stock, are public information in the Secondary market and help obtain the best match and the highest value in trade. Similarly, the quality of Matchcoins derives from the appropriateness of the 'match' between ConsumerCoins and Bizcoins. FIIs, who receive Matchcoin applications toward durable loans/investment funds from both Consumer (Cooperatives) and Businesses, disburse the same on the basis of the quality of Matchcoins submitted. Infact, the elicitation of the highest value in trade by the matching of the ConsumerCoin-BizCoin attribute-vectors, is necessary to creating a Matchcoin of the highest quality. Given both ConsumerCoins and Bizcoins are associated with an attribute vector specific to the domain in which they were distributed, and modified further by the recipients’ behavior, their pairing in the Secondary market brings about a product-matrix of 'salient issues' that are particularly relevant, both to FIIs in their evaluation of Consumer loan and investment capital, and to the IMF/WB policy-makers in their task of designing efficient and targeted policies that enhance sustainability and efficiency. For example, the matching of cancelled, but unmatched ConsumerCoins to cancelled, but unmatched Bizcoins (thus creating a 'Cancelled CC-Cancelled BC' string), brings in to existence a ‘CC-BC MatchCoin salience matrix’. Matchcoins with a significant ‘salience matrix’ are preferred over lower-quality Matchcoins by FIIs for the concentrated and sure opportunity that they represent. These MatchCoins, then, both constitute the origin point of CompCoin fractals and the narrowly-targeted, scale-up opportunity implied by the product-matrix of vector attributes.

Should Consumer tastes, competitive choices and WTP embodied in the ConsumerCoins dovetail with firm efficiency and product niche of the Bizcoin-owning firm, the 'Match' is deemed of higher quality, and the more immediate is the monetary opportunity for the FII to finance a sustainable expansion of production. For instance, if the FII had distributed ConsumerCoins among the impenured, and BizCoins to a dairy firm with high cost of capital, then a Matchcoin resulting from pairing the two in the Cheese market would indicate an immediate opportunity to fund capacity expansion with FII-bankrolled low-cost capital to serve incremental consumer Cheese demand. Such proposals for investment loans are then expediently funded with gold-monetized EO-CC Scale capital to secure a larger market share for foreign dairy technology.

The Import of CompCoins and MatchCoins

In making their Consumption vs Durable purchase decisions, the FII-favored households engage in multi-dimensional trade-offs that reveal their preferences and constraints in the context of wages, income, prices and interest rates. Similarly, the behaviour of BizCoins-endowed firms reveals as much their technology, as competitive (and ESH/social) pressures, prevailing market prices and rental rates. These choices, which yield observable variables, are valuable to FIIs that serve as financial partners, economic affiliates, and as technological outposts for the IMF/WB, and exploit opportunities while investing in the nation's growth. In turn, the behaviour of the FIIs reveals their perspectives, political affiliations and objectives, their opportunity cost of capital within and beyond the nation, and indeed, the worth of information- and Cause-rich CompCoins at the Gold-monetization rounds abroad.

When uncancelled ConsumerCoins are paired with cancelled BizCoins, and the Matchcoins so created submitted to the FII toward loans for consumer durables, the FII is additionally informed of raw material and labor market conditions. Analogously, when uncancelled Bizcoins pair with cancelled ConsumerCoins, the Matchcoins so resulting embody information on Consumer preferences and constraints. When pooled, such information is valuable, both, to FIIs who leverage them in decisions concerning allocation of investment funds and loans for Consumer durables, and to IMF/WB who leverage them to design appropriate remedial policies.

Unmatched, but cancelled Compcoins, whether ConsumerCoins (such as when Consumers seek an infeasible discount on purchases) or Bizcoins (when firms seek too low a wage or input cost), are symptomatic of sustainability deficits that, generally, cannot be resolved without 'structural intervention' or new innovations, if at all. In a sense, CompCoin assignees, both Consumers and Producers, signal with their choice of discounts and price-markdowns they seek in the various Consumer and input goods. Cancelled Compcoins associated with infeasible discounts and markdowns command lower prices in the Secondary market. In such cases, it’d be necessary to append a technological or policy strategy to these Cancelled, but unmatched ConsumerCoins and BizCoins, when seeking capital at Gold monetization rounds. Such capital could either fund investments, policies and programs, or, fund innovation in new technologies that turn the currently infeasible in to potential reality, and thus advance society toward a sustainable future. Thus, the IMF and the WB drive, both, the policy agenda and, with participation of the FIIs, create the necessary resources for investing in, and achieving its goals.

Sustainability and Innovation

Conceive of a society in which there is a perpetual tug of war between Sustainability and Innovation at the margin to increment a sustainable and aural core economy. While a focus on sustainability necessarily requires equity resolutions, innovation places emphasis on efficiency. Thus, investment in innovations are oftentimes suppressed in nominal regimes, ostensibly for equity reasons, and fast-forwarded in other times for commercial and strategic reasons. It remains however, to devise a rule, even a rule of thumb, to guide decisions concerning the pace of innovation as it applies to the monetization of (Non-) Sovereign Gold to Innovation Dollars. Toward this goal, consider a tentative rule that hypothesizes that prospective social (Market) returns to Innovation must be greater than or equal the sum of prospective returns to Sustainability Bonds and prospective returns to Lifestyle & Product quality (CC Equity Returns). Thus, and when the society turns unsustainable and inefficient, current returns to the ‘Sustainability Cause’ and ‘CC Efficiency Goal-Target’ shrink even as prospective returns to Innovation enlarge. Conversely, when members of society deem their environs sustainable and livable, the returns to Sustainability pursuits and Efficiency ventures shrink, and so do Innovation programs and budgets. Put another way, should the economy be both inefficient and unsustainable, the prospective returns to CC Equity falls, as do returns in Sustainability Bonds, thus setting a sufficiently low threshold for prospective returns to Innovation efforts. The converse exemplifies the case of a society with positive efficiency and sustainability rents that require incremental innovation to pass a higher return threshold.

Gold-monetizer@imf.borg

Gold, the perpetuator of Sustainability, and indeed the underwriter of the inter-mediating gold-based monetary system - a system in which Cause-embodied Sovereign/non-sovereign gold is monetized to Sustainability Gold ETFs and Innovation Dollars at variable multiples - arguably must also resolve any unsustainability that it tolerates in the form of an inflationary, nominal economy. In this context, consider IMF that serves as the repository of Sovereign gold, and World Bank, which through FIIs holds non-sovereign gold, both which have the authority to issue monetary capital by monetizing gold. While the IMF monetizes its store of Sovereign Gold to Sustainability Gold ETF capital and applies them to remedy instances of socio-economic unsustainabilities, the World Bank monetizes non-sovereign FII-Gold to Dollar-denominated Innovation-seeking capital aimed at expanding the social pie through technological advances.

Parallely, Political parties with votes, and FIIs with CompCoins compete for both, Sustainability Gold ETFs and Innovation-Efficiency Dollars. Votes and CompCoins with an efficiency-twist (as determined by the context in which they were generated) are routed to World Bank for exchange against fresh gold-monetized Innovation capital. Should they instead be more equity-seeking, the same are exchanged for Sustainability Gold ETFs monetized from gold by, and at the IMF. These monetizations create incremental low-cost capital that may then be gainfully applied to ward off significant future unsustainabilities by funding equal opportunity policies, programs, and anticipatory innovation.

To this end, consider a monetizing authority such as the IMF/WB, that seeks Preferences-, and Cause-rich Compcoins, numerically-cancelled Votes, and other information-rich instruments supplied by competing FIIs and Political parties, along with (non-) sovereign gold, to motivate and create gold-monetized capital, ie, Sustainability Gold ETFs and CC Innovation Dollars. While political parties exchange platform/niche-specific votes garnered by them in elections for (non-)monetary compensation, FIIs offer cancelled, unmatched Compcoins to buy in to Gold-monetization that endow them with Sustainability-seeking equity capital, or innovation-capital. The underlying logic is the motivation of, and transfer of the preferences and causes in the Vote blocs/Compcoin sets to the creation of capital that achieves/satisfies/resolves them. The process works much like a typical supply-demand-driven market: FII supply curves for cancelled CompCoin (both ConsumerCoins and Bizcoins) that are upward-sloping in gold-monetization multiples, and IMF/WB demand curves for cancelled Compcoins that slope downward. The intersections represent the respective equilibria, ie, the FII-specific monetization multiple at the margin at the two organizations for the two kinds of capitals.

To rate the Votes and ECC-Compcoins toward Gold Monetisation, the monetizing authority, here, the Central Bank or the IMF/WB, creates and leverages a 'Futcoin' taken on the expected future/terminal value of common-to-FIIs, comprehensively-defined, untraded Global Sustainability Bonds. In 'Futcoin What-if rounds', the monetizing authority verifies the potential Futcoin value gain, the ‘Futcoin Delta’, from resolving the Causes embodied in each Vote bloc/Compcoin set). In other words, the What-if resolution of causes/issues in each CompCoin set/Vote bloc increments the NAV of the underlying index-driven Sustainability Bond in a formula-predicted way and reflects in a change in Futcoin value, ie, the Futcoin Delta. This might involve the monetizing authority verifying the WTP - overt or implicit, and the remedial prescriptions for correcting the unsustainabilities. Policy strategists and Technology Consultants have an important role to play in this context. The monetizing authority then apportions to each Compcoin set/Vote bloc, a Gold monetization-multiple based on its Futcoin Delta. It is these multiples, tagged to Compcoin-stringed fractals, that are engaged and discharged with the issue of Gold-ETFs, Innovation dollars, and Matchcoin-CC-Scale Dollars in High-Frequency-Trading, HFT, monetization rounds on (Non-) Sovereign Gold at the IMF/WB.

CompCoin Fractals

Compcoin fractals are constructed subjectively and uniquely by FIIs from cancelled, unpaired Bizcoins, cancelled, unpaired ConsumerCoins (and paired MatchCoins) following the logic of symmetry and Futcoin delta rank. Each inverted-V shaped fractal is populated with ConsumerCoins and BizCoins on opposite sides starting at the extreme with the Compcoin associated with the largest-rated Futcoin Delta. As one moves from the flanks toward the centre of the fractal, the delta falls, until, and in the extreme, ie, at the centre of the fractal, the Nirvana point, is located a Matchcoin that is 'barely' unsustainable (the benchmarks for unsustainability varying across FIIs). Thus, a Compcoin fractal strings, on either flanks, instances of excess inefficiency and excess inequity, both which imply higher societal risk if ignored; the MatchCoin positioned at the Nirvana point on the fractal represents a sustainable instance of immediate FII scale-capital infusion.

Now conceive of a set of these fractals from different FIIs with stringed, cancelled, 'futcoin-delta-evaluated' and 'monetization multiple-calibrated' coins from different nations brought to the IMF and WB. The fractals are bounded from above by a horizontal line that signifies both, a perfect real economy and a unitary monetization multiple - characteristic of developed nations with sustainable technologies, and from below by deep inverted-V fractals symptomatic of nominal economies in failed States and which intersect higher monetization multiple iso-contours. These fractals theoretically would share a common Matchcoin point at the centre; however, the different diligence and Matchcoin quality benchmarks held by the various FIIs imply they are stringed vertically, if not bunched together (See Figure).

Given different FIIs source their coins from different lands and with different strategies, they have differently-shaped fractals that intersect different iso-monetization multiple contours. Shallow fractals, shaped like a roof-top, populated by low-multiple Compcoins, and approaching the horizontal, likely imply a balanced society that is near sustainability. Such fractals overlie deeper fractals that resemble a ‘deep inverted V', and are symptomatic of egregious unsustainabilities prevalent in failed States. The rule-based monetizations at the IMF and the World Bank proceed simultaneously on the two fractal flanks. Calibrated to monetization-multiples, the monetization proceeds by engaging Futcoin-tagged Compcoin fractals and generate, respectively Sustainability-Gold ETF capital from cancelled, unpaired ConsumerCoins and CC-Innovation $ capital from cancelled, unpaired Bizcoins, while the Matchcoins at the centre are monetized by the respective Central Bankers to national-currency-denominated, CC-Scale capital.

HFT and Monetization Triangle? What be they?

Post the Gold-monetization, it is necessary to infuse the incremental Sustainability-, Innovation-, and Scale-capital in to the global and national financial markets. The strategy adopted here centres around the concept of HFT trading around a ‘Monetization Triangle’. HFT refers to High Frequency Trading in capital markets executed through ultra-fast computers. HFT trading obtains smoother, even continuous trade prices that minimize liquidity-losses to Bond sponsors and market participants, and brings about rapid closure of arbitrage opportunities across asset-classes and nations.

The Monetization Triangle, as in Figure, is comprised of 3 paired markets: 1. An IISD-sponsored Global Sustainability Bond market opposite Country-specific ECC Bonds, sponsored by Nation’s Planning authority, 2. The World Bank supported Global CC-Equities market opposite the FII-Consortium-supported Country-specific Domestic CC-Equity markets, and 3. The FII-Consortium-supported Global FX opposite the country-specific CB-supported Inflation Hedge Bonds. The IMF, the World Bank, and the Country-specific Central Banker infuse/place the newly-monetized capital in periods when HFT trading harvests arbitrage opportunities between Bond prices, equity prices, FX and inflation expectations between these three paired, inter-linked markets. HFT trading facilitates the elicitation of 'monetization criteria- and -intervals' from trends in these markets, and its calibration with the magnitude of gold to be monetized.

Let’s consider the three capital infusions sequentially. In the case of the Gold-ETF-mediated Global Sustainability-ECC Bond vs FX-Inflation market, this strategy involves exploiting all trading intervals of expanding bond differentials due a fall in ECC Bond NAV, AND opposite movements in the FX-Inflation market (ie, an exacerbation of domestic inflation and a weakening of the national currency relative the Dollar) to issue Gold-monetized Sustainability ETFs. Such capital supports the ESH- and EO cause in the imperiled nation either through UN agencies or as budgeted programs.

A similar logic applies in the Sustainability Bond-Global Equity market. Gold-monetized Innovation dollar capital is issued when the NAV differential shrinks due opposing movements in Global Equities and Sustainability bond markets. These Innovation dollars support global equities in competition with lesser (nation-specific) equities; ie, the fresh innovation-supporting $ liquidity being directed by FIIs to support firms with superior product-quality in zero-sum against firms with inferior product quality, thus denying an Equity-bubble despite the infusion of Innovation capital.

Finally, and in the nation-specific FII-Consortium-dominated Domestic Equity market vs the FII FX-CB Inflation-Hedge Bond market, Matchcoin CC capital, denominated in national currency and representing Gold-monetized CC Scale capital for existing scale-up opportunities, are issued to the respective Nation's Central Banker by fractal-monetizing Matchcoins at near unitary multiples when the country-specific Equity Market - Inflation Hedge Bond differential increases despite an increase in inflation (suggesting existence of scale economies) AND the Nation’s currency appreciates relative the Dollar. Notably, Gold-ETFs issued in the ECC Bond-FX market by the IMF, and which might stoke liquidity-induced volatility in the Bond markets, is curtained in the FX market that converts ‘excess’ Gold ETFs to country-specific, $-denominated EO-Scale capital every time the national currency strengthens relative the $ AND inflation abates. These ‘Inflation-Negative’ EO Dollars pair with national currency-denominated, ‘inflation-positive’ CC Matchcoin Scale capital to expand the Nation’s domestic production capacity sustainably. This strategy offers an apposite resolution to trade-motivated exchange rate manipulations that reduce the environment, both domestically and globally.

These strategies involving integrated Bond, Equity and FX (cross-sectional) and Inflation (Time-series) markets ensure that Sustainability-, Innovation-, and Scale capital are allocated judiciously across markets and nations, with defensible economic/environmental/social logic, and bring about the desired change toward incremental innovation and sustainability in the quest toward a larger, technologically- and socially-sustainable economy (beside stabilizing FX and trade flows).

Monetization: the Nitty Gritty

Next, conceive of stacked fractals from competing FIIs that are laid over horizontal iso-monetization-multiple contours that increase numerically vertically downward. For any given set of (non-) sovereign Gold bricks offered for monetization, HFT proceeds simultaneously and three ways: 1. as a ‘convex-to-the-Matchcoin-origin’, IMF-Monetization wave-front that moves diagonally up from the left flank of the inverted V-shaped fractal(s) and engages ConsumerCoins tagged with Futcoin-delta-based monetization multiples and generates Sustainability capital; 2. a similar WB-Monetization wave-front that moves diagonally up toward the Matchcoin-origin point along the right flank and discharges the tagged Futcoin-Delta-multiples while transforming (Non-) Sovereign Gold to Innovation capital, and 3. a crescent-shaped Central Banker's Monetization wave-front that descends vertically and monetizes Matchcoins at the Nirvana-point of fractals to 'CC-Scale Capital' (along with some adjacent, low-multiple Compcoins woven in to shallower fractals).

Much like waves in a transition to high tide, every incremental monetization pass re-scans the pan-FII fractal topography incrementally until the Nirvana point is reached for the top-most fractal (or, the wave-front discharges a specified Matchcoin point). These waves advance with the fulfilment of the three conditions and recede when the same is not met, thus providing for a real-time market interpretation for the underlying monetization logic. Thus, fractal-based monetization creates fresh capital on the set of gold-bricks - the larger unsustainabilities implicitly underwriting the issue of Sustainability or Innovation capital many times more than the smaller ones. Post monetization, the FIIs are handed their half-share of the freshly-created capital which they apply to secure the equity and innovation opportunities at their various global outposts.

Gold-Monetized Capital: A wrap up

Between the supply of, and demand for CompCoins and Votes on one hand, and the tug of war for Sustainability capital and Innovation capital at the IMF and the World Bank, the proposed system creates the right amounts of Sustainability Gold ETFs and Innovation $ capitals specific to each nation and in equilibrium with global equity and bond markets, thus ensuring an equitable and efficient resolution of the various causes brought to the monetization tables by the FIIs. Further, the IMF and the WB leverage information on unsustainability and technological opportunity embodied in Compcoins obtained post-monetization to partner with issuers of ECC Bonds and policy-making institutions from member nations to design targeted remedial structural policies and programs that solve the embodied unsustainability and exploit the innovation opportunity with the freshly-minted sustainability or innovation capital. Post-monetization, the IMF and the WB invest their share of capital in funds, policies and ventures that adopt their recommendations.

Capital Moves !

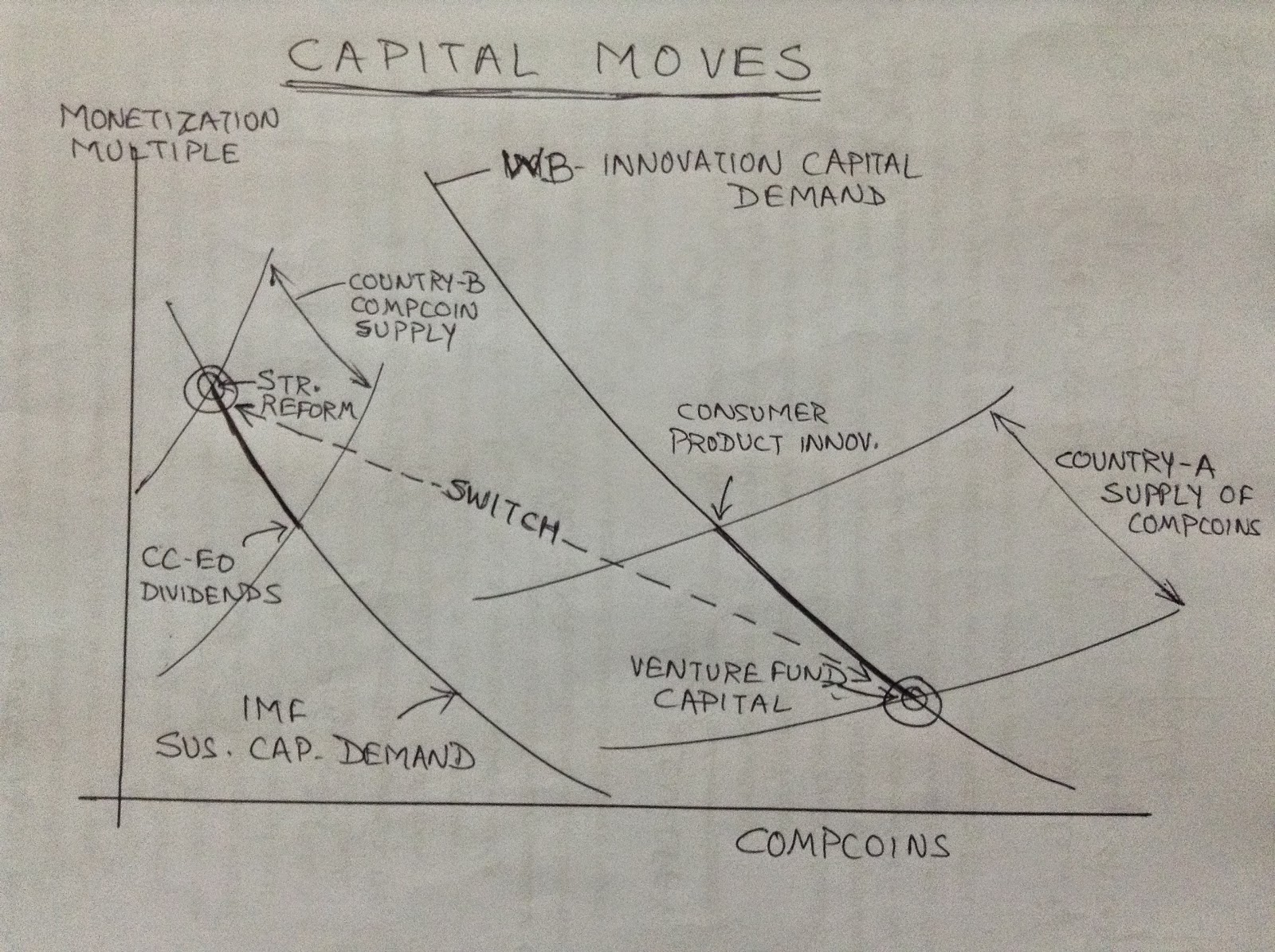

While the above is a defensible means to create incremental capital, there is a pareto opportunity in exploiting, on one hand, the country-specific macro-economic cycle, and on the other, the cross-sectional variation of the state of sustainability and innovation across nations to bring about a more equitable and more efficient world. To better understand this opportunity, let’s return to the supply of, and demand for Compcoins, depicted as the familiar Marshallian cross against the Monetization multiple (Figure). Assuming that the supply of cancelled Compcoins varies with income-related WTP and patriotism of the Compcoins assignees (remember, Compcoins are Deficit/Debt coins), and further that the IMF/WB demand for Compcoins is stable in the aggregate, one may trace a series of equilibria that effectively coincide with the respective Compcoin demand curves. The two traces, one for EO capital and the other for CC-Innovation capital are specific to each nation. Both traces are downward sloping, reflecting the fact larger multiples translate to more, lower cost-of-capital resources.

Now consider the CC-Innovation trace for a Developed nation that is a further shift to the right of the EO-Sustainability trace for a Developing nation. While the two extreme points on the EO-Sustainability trace - the high- and the low-multiples - represent intended recipients/programs in Developing nations, say, cost-reducing Structural reforms and Sustainable CC-EO Dividends in a per-capita, subsistence economy, respectively, the corresponding points on the CC-Innovation curve represent such potential recipients as Innovation in Consumer products in a Lifestyle quality economy and Venture capital funding. In a global economy, however, and one beset by planned and unplanned gyrations characteristic of a nominal regime, it is opportune to exchange the high cost EO-Sustainability capital in possession of IMF/Developing nations with the low-cost CC-Innovation Funds with WB/Developed nations. Thus, Structural reforms in Developing nations, that should have been hampered due high cost Sustainability capital may instead be funded with low-cost Innovation capital from the Developed world while Venture funds that would have otherwise been funded with low-cost of capital Innovation funds monetized by the developed nations at the WB, are now funded by higher cost, higher threshold, Sustainability capital monetized by the IMF for developing nations. This exchange ensures structural-reforms in developing nations funded by multi-lateral international organizations are CC-oriented, and Venture-funding in developed nations sustainability-constrained.

An Almost Real-world Example

With the patriotic Planning Commission and the not-so-patriotic FIIs monitoring trading in the Primary and Secondary markets, the democratically-elected politicians awaiting their nominal desserts, and the masses sandwiched between the two, the stage is set for rolling out the design. When the Government begins its term by exploiting the camouflage of public expectations to enact/engage in nominal subterfuges, corrupt practices and unsustainable policies, the Corruption-, ESH- and the Efficiency sub-indices reflect the same and shrink the NAV of the ECC Bonds. Perceiving opportunity, the funds-rich FIIs buy out the Bond and issue ConsumerCoins and Bizcoins that compensate various sections of the society for losses suffered due inequity, corruption and inefficiency.

Nothing illustrates a point as would a realistic example. Consider a developing nation with a nascent energy industry. Choked by high cost of capital, policy inefficiency and uncertainty, and by lack of scale economies due a tepid consumer demand (a response to high prices), the sector witnesses impending signs of collapse. The endemic prevalence of inequity, corruption and inefficiency in core infrastructural sectors motivates the Nation’s Planning Authority to respond with corrective index-driven ECC Bonds (issued, say, at NAV 10, and a DTV, 100). An FII buys in to the Bonds when its NAV falls to 6 and its EATV to 40, and issues compensatory Consumer coins and Bizcoins to Producers and Consumers of energy-intensive products and services. These Compcoins assignees apply it to lessen the impacts of the malaise on their well-being/operations. Post use, the FII purchases the cancelled Compcoins in the Secondary markets, and documents to the IMF/WB in ‘What-if Futcoin’ rounds how the inefficiency in the energy sector reduces the prospects of firms in the industry, how higher prices impact upon consumer utility and lifestyle, and how its Policy- and Consulting partners intend to remedy the matter with fresh, low-cost capital. The IMF and WB transform the Monetization-multiple-appended FII Compcoin fractal in to both Sustainability capital and Innovation capital and share the same with the FII. While the IMF and WB design and sponsor structural reforms for the imperiled nation with their share of the monetization proceeds, the FII places its share of resources, both, to fund innovation and competition in the energy sector, and to benefit in the capital markets from the IMF/WB-suggested structural reforms. As the reforms take hold and the energy sector is re-invigorated with efficient policies, uncertainty recedes, energy-firms exploit the low cost of capital resources offered by FIIs to expand their operations sustainably and ‘scale-efficiently’, and offer both, more choice and lower prices to consumers, whose lifestyle increments count as utility and GDP gains. Responding to gains in sustainability, policy efficiency and innovation, the Divisia indices underlying the ECC Bonds register increments and the Bond gains in NAV (to, say, 14) and EATV (to 70). Compcoin prices, that had increased due a contraction in the nation’s future, head downward as the spectre of anarchy and an obsolescent economy recede and the nation resumes its journey on the path to a larger economy and a sustainable society. The FIIs, too, re-strategize around incrementally smaller unsustainabilities and larger WTPs, and the newer issues brought about by technological advances and globalization, to stake a fresh round of ECC Bonds, thus re-starting and re-inforcing their role as catalysts-pareto agents in the pursuit of emancipation of underdeveloped nations, and as financial and technological outposts for the developed nations.

The Post-mortem: Delayed Gratification?.....Or, Judgement Day?

The IMF/WB conduct a performance review post the issue of Gold-monetized capital and its investment in Sustainability- and Innovation-enhancing pursuits. Empowered to blacklist FIIs that grossly mis-represent claims, the IMF/WB reviews the accuracy of claims made during the elicitation of the Futcoin-Delta, and the progress toward sustainability claimed in 'What-if Futcoin' rounds that preceded the creation of gold-monetized capital against realized Sustainability/Innovation gains. Should gains as objectively-measured on the Sustainability Divisia index be consistent with claims, and have demonstrably enlarged the social pie as measured by the NAV of the index-driven, nation-specific ECC Bonds and domestic equities, the IMF/WB releases the lien on the monetized Gold brick and returns/offers it to the FII, in effect rewarding the FII for achieving the Sustainability/Innovation goal. However, should the goal elude the society, the IMF/WB has the option to either take possession of the FII Gold under monetization-lien, or issue Gold ETFs/Innovation $ that are charged to the erring FII in subsequent monetization rounds, and offer them to more successful FIIs until the goal is achieved. Thus, the review serves to straighten FII intentions and incentivizes FII-performance in the achievement of Sustainability and Innovation goals with significant rewards and losses of financial opportunity.

Some Final Thoughts

The long-run is but a series of short runs, or so would claim those who swear by nominal economics. Yet, the accommodation of inefficiency, inequity, obsolescence and corruption in the cover of populist policies that claim to satisfy all sections of the society simultaneously could trigger sustainability hives and ‘innovation-dives' in the economy. Given the nature of popular democracy, politicians cannot be faulted for pursuing a nominal path to diffused societal gratification, but which debilitates the real, long-run future of the nation. Such incentives deepen the schism between society and sustainability and, over time, bring the nation to the brink of economic and environmental disaster. The lack of credible alternatives is often the cause behind the exacerbation of exploitative social ills. In fact, Corruption is one such ill that expands for the absence of an alternative. While critics may claim monitoring and enforcement is what lacks, the truth is uglier. We have tolerated Corruption, even internalized it in to our nominal society; the Administration, immune to our anger, has turned Corruption a fine art perfected and practised by Politicians, by Businesses and perforce, capital market participants. It has, hence, turned necessary to anticipate a further exacerbation of the malaise in a nominal economy with an almost draconian alternative - that of an eventual takeover of our economy by the IMF, WB and its partnering FIIs - as the spectre that returns us back to our senses.

The design presented above is certainly not the most compact or expressly implementable. But, and in the context of the trillion-dollar global stakes, it does take a long-term and expansive view of the ills begotten by the three-headed snake on the national economy in a globalised society. By tying the ‘nominal ills’ to objectively-measured indices, pricing both conformance and deviations from the index-driven design values in the market, participating experts and the public/firms in the determination of real values and nominal latitude, and further, benchmarking sustainability and innovation to global standards advocated by the IMF and the WB, the design offers a global, yet nation-specific solution to the malaise. It proposes a strategy to generate and assign incremental Sustainability and Innovation capitals that is both efficient and equitable, is consistent with global monetary flows, national fiscal policies and international trade while stabilizing exchange rate volatility and countering inflation. The proposed system is designed to induce competition among FIIs to pro-actively seek out sustainability deficits in the various facets of the society, and generate, both, the capital to correct them, and the prescriptive policies for the same. The design permits nations to integrate with the international sustainability benchmark at an endogenous pace, determined by the politics, institutions, and people at large. It is likely to obtain long-term resolution of the ills that accompany a nominal regime within the ambit of competition for ownership of the domestic economy - a cause large enough to be serious about eradication of the nominally-engendered social malaise.

Ganga Prasad Rao

gprasadrao@hotmail.com

Disclaimer: The author does not vouch for the purported outcomes of the design proposed herein under. Actual outcomes could vary due economic and financial market dynamics. (Errors, Omissions and Death threats excepted !!!)

Introduction

Inequity? Corruption? Inefficiency? Social and Environmental unsustainability? So what's new in the nominal economy? These are age-old malaise, much as are Vice and Slavery. To root them out would be denying human greed, -sensitivities, -errors, and indeed, human urges that incentivize our actions (and inactions!). But should we condemn ourselves to these excesses and tolerate them as they pervade our public space and private life, erode our constitutional rights and personal freedom? Shall we, (un)like the proverbial followers of Moses walk across the dry bed of the River Jordan and seek a miraculous change of heart in our political masters residing in the mountainous headwaters? Or, attune ourselves to the times, align with the madness we call political euphoria, and congratulate ourselves for joining the crowd of self-deceivers and participate in ‘The Grand Nominal Lie’? And if the answer to these questions is a resounding No, then where lies our salvation? Or, more to the point, How?

Here, I present the outlines of a sophisticated, albeit an elaborate global strategy built around the creation of Sustainability-, Innovation- and Scale-capital from expressly-designed 'CompCoins'/'Futcoins' derived from index-driven, Enhanced Closed-cycle, ECC Cause Bonds and their post-processing at the IMF and World Bank. The design provides an ingenious means to recover socio-economic issues, motivate the generation of apposite capital, and invest the same to alleviate those issues. By compensating, on one hand, victims of the nominal economy with ‘CompCoins’, and funding remedial reforms and innovation on the other, the proposed design brings about an endogenously-controlled, market-driven, international monetary-cum-national fiscal system. The proposed design offers monetary support for the ECC Cause Bonds that explicitly target social malaise, compensates victims of corruption and unsustainability, and offers growth opportunities to the economy. The scheme is global in scope and offers a means to incentivize nations to innovate, and adopt equitable and efficient policies as appropriate to the preferences of its people. It is also consistent with the existing global monetary system and with national fiscal policies.

The 'Motivating Model'

God deigned there be two genders, male and female, two color extremes, black and white, two moral states: good and bad..... and two polar economic paradigms: Real and Nominal! For our purposes, lets define the 'Real' as an efficiency-maximizing, FV-oriented, production- & investment-intensive and an innovation-seeking economy. The Real economy targets maximum efficiency, adopts new technologies rapidly, and offers market-determined employment opportunities unmindful of innovation-related labor impacts. In contrast, the PV-oriented Nominal economy is one that appeases various political, social and economic interests. Adopting ex-ante a cyclical GDP macro-strategy, and despite the resulting environmental degradation, it accommodates inefficiency in production and services and stock-market speculatory greed to support labor demand. Implicit to this nominal paradigm is the political manipulation of the pace of innovation and technology adoption. Such accommodation opens the door to inequity, inefficiency and corruption. Between the polar extremes of the 'idealistic real' economy and the 'expedient nominal' stands the Aural economy, the Global Sustainability benchmark, and a sponsor of the gold-based 'mediating-monetary system'. Sponsors of this system seek societies that expand sustainably - a sustainable compromise between the two polar paradigms across the various social dimensions and macro-economic phases.

If the gulf between the real and the nominal economies originates in inequity, inefficiency, and public ESH externalities - all of which are impacted by policy-inefficiency and political - misgovernance, aka, Corruption, and by the mis-timing of innovations and their adoption, ie, political accommodation of obsolescence, the same may be leveraged to design index-driven, ‘Enhanced Closed Cycle, ECC Cause bonds’. In the context of a PV-focussed nominal economy, consider Closed-cycle Bonds that espouse the idealistic cause of maximal production efficiency within a closed material- and product cycle that does not release waste to the environment whether in production, transport, consumption or disposal. While these CC bonds recognise waste discharges due production inefficiency, their diligence does not extend to Environmental Safety and Health (ESH), or for that matter, equity issues such as Corruption in political governance, or political judgements concerning the rate of technology adoption. It is therefore opportune, in the context of the Real-Nominal divide that is motivated by larger societal issues, to modify CC Bonds and include ESH-, Innovation- and Equity-related impacts as well - their inclusion further extending the scope and duration of the Bonds, (now mimicking Global Sustainability Cause bonds) and the exactitude of its goals. Thus, each Nation's ECC Bonds represents and fills the gulf between its nominal and the real economies, and may validly claim, if indirectly, to capture ESH-, Corruption and Innovation-related inefficiency as well. They are, in a sense, societal debt bonds that turn assets upon achievement of the Cause.

An ECC Bond may be thought of as the equivalent of a promised Forward contract on a distant 'SGDP FV Society'. Sponsored jointly by the Nation's Sovereign Fund with an 'SGDP Oo' and with a ‘CC 2’ by the FII Consortium, and meant to be the national counterpart to Global Sustainability bonds, they are issued upon formula-driven, multi-tiered, nested divisia-indices of the underlying determinants. The Divisia-construct increments for production-, transport-, consumption-, and disposal- efficiency, ESH-sustainability, equity improvements and technological advances, but shrinks to reveal the impact of inefficiency, ESH-deficiencies, inequity-enlarging Corruption and the political accommodation of obsolescence. The resultant index value correlates directly with ‘Design NAV’ around which the ECC Bonds are traded. ECC Cause Bonds have a design terminal value pegged to 100% efficiency, zero inequity and zero corruption - an idealistic benchmark unlikely to be met over the Bond term. They are issued by a Government authority, such as the Planning Commission, to a select group of Sustainability Believers-Sustainability Judges, (SB-SJ), and Cause Participants-Expert Investors, (CP-EI), who are offered an 'SGDP/CC Judge Group Oo Share' for holding the Bonds and overseeing the achievement of its goals.

The definition of the closed-cycle 'fundamental evils' is critical to the design of ECC Bonds. They should, at the same time, be well-defined, globally-consistent, comprehensive and naturally-bounded quantitative, relative- or ratio-measures, yet rely on publicly-sourced, verifiable data and measures. These data would then combine through nested, multi-tiered variables in to Divisia indices that peg the 'Design NAV' appropriate to the current level of the evils. A nested, multi-tiered design permits the consideration of a large number of even minor factors that aggregate in to variables comprising the upper tiers that explicitly quantify the Design NAV. (The market NAV would reflect expectational/anticipatory volatility and other supply and demand considerations that disperse the actual NAV around its design value). In other words, the NAV of the ECC Bonds, whose maximum is limited by the utopian, if unachievable world of total efficiency and equity, rises from its issue price to a value-band that brackets the intrinsic index-driven value indicated by the Divisia formula underlying the ECC bonds.

The three scourges - Inequity, Corruption, and Inefficiency - themselves Divisia-indices of components, and which together determine the Design NAV of ECC Bonds, must yet be weighed in to the index driving the NAV of ECC Bonds. While one could attach weights arbitrarily, the same could be recovered from an econometric estimation. That estimation, exploiting time-series data on the various determinants of Real GDP net of imputed ESH Damages - Technology, Resource Endowment, Infrastructure investment, Education, Political system, and indeed, Inequity, Corruption, and Inefficiency - and exploiting flexible functional forms, would yield, upon estimation and further derivations, expressions that reveal the partial impact of the various determinants, including the three scourges, on Real GDP. These, upon further manipulation, would yield elasticities that likely serve as an excellent set of weights to attach to the index that drives the ECC Bonds.

Thus designed, the ECC Bonds serve to quantify the country-specific efficiency, equity and sustainability impacts triggered by, and prevalent in the expedient, nominal economy within the larger context of global sustainability.

Complementary (and Supplementary) Coins

The ECC Bonds, being 'SGDP Oo Innovation Ookey'-embodied Cause-bonds to begin with, do not lend themselves to active trading, and in any case, may not be denominated to facilitate widespread holding among Investors and Consumers. In such instances, one could resort to issuing Coins upon the asset or debt and permit market uncertainties and expectations to price them. Coins represent the divided FV, divided and discounted PV NAV of the expected terminal value, ETV, of the underlying untraded asset (or debt) whose current value varies consistent with its intrinsic valuation, as well as supply & demand factors including market-related expectations. Given both ETV and discount rates vary across time periods, Coins issued on assets rise with higher ETV and lower discount rate, and fall in value in periods of lower ETV and higher discount rates.

Given a Cause Bond issued at NAVto with an idealistic Design Terminal Value at time T, DTVT, that currently trading at NAVt1, one could decompose the ‘DTVT-NAVt1 net’ in to ‘Comp(lementary)Coins’, representing the anticipated eventual shortfall relative to DTV, DTVT-EATVT, and ‘Supplementary Coins’, representing the anticipated gain over NAVt, EATVT-NAVt. A 'CompCoin' may be conceived of as the current divided market valuation of the expected net between the theoretical maximum of index-driven ECC Bonds, DTVT, and its Expected Actual Terminal Value, Et[DTVT] (=EATVT) at the end of the term. Put another way, Complement Coins represent the current (discounted) expectation of the future net between the DTVT and the EATVT; its traded value varies as much with expectations around that net in each period as it does with discount rate and market-related speculative factors. The value of these ‘deficit coins’ represents the extent to which ECC Bonds are expected to fall short of their DTV, and hence offer a probabilistic peep in to the attainability of the cause underlying their issue. CompCoins increase in value as the 'expected sustainability shortfall' increases with an expansion of inequity, corruption and inefficiency and fall when the ECC Bonds increment in value to indicate progress toward the SGDP goal. For any given net, they expand when the discount rates falls, reflecting a heightened concern for the future, and vice versa. (Compcoins, because they permit trading gains upon anticipated deficits, trigger ‘Cause Obligations’ that force the pace toward achievement of the Bond Cause). Thus designed, Compcoins also permit the elicitation of perceptions of transitory or permanent impact of current policies. Should current unsustainable policies be perceived to hurt the society in the long-run also, the EATV of the ECC Bond tranche falls and Compcoins rise in NAV. Should current unsustainable policies be presumed transitory, reversible or easily recovered from, the Bond EATV holds close to DTV, and Compcoins show little change in price. Unlike CompCoins that reveal the expected shortfall in achieving the Cause, Supplementary Coins embody expected gain to maturity due expansion of the EATV, or contraction of the current NAVt, or both. Their value is likely to correlate negatively with that of CompCoins. CompCoins and Supplementary Coins, together substitute for the original bond, and hence obviate trading in Bond units.

The FII-PC (Macro-prudential) Tango !

Now consider an FII that nominally or otherwise positions itself in the opposite of the ECC Bond issuer, here the Planning Commission. Post the issue of ECC Bonds and its assignment to 'Sustainability Believers-Cause Judges-Cause Participants-Expert Investors’ (SB:SJ:CP:EI), the FII, in competition with other FIIs, awaits an opportune time to buy out an entire tranche of ECC Bonds, ie, the transfer of the EATV corpus of a particular tranche of ECC Bonds against a post-dated P-Note that it offers to the Planning Commission, and which serves as a conditional post-dated 'Bonus' for the transfer of rights to the Bond issue and its EATV corpus.

(Issued at the bottom of the rate cycle, but without fresh liquidity, by a National planning authority, the ECC Cause Bonds achieve their purpose of reducing inefficiency and corruption in the economy by (also) turning investment-capital and working-capital costly in an environment of rising interest rates. Should inefficiency and corruption enlarge despite the rate hikes that accompany a resurgent nominal economy and cause the index-driven NAV of the ECC Bonds to fall sufficiently for the FII to evince interest and buy away the corpus, the Planning Commission recommends the issue of fresh liquidity underwritten by an 'SGDP Enemy Opposite 2 Share' fund line, equal the value of the current Bond corpus against the post-dated FII P-Note, while the FII contributes a Dollar-denominated 'Friend Apposite Innovation Oo Share' line of liquidity to the Equity market in amount equal the decrement to Bond corpus relative to its issue size. These fresh infusions of liquidity are best applied to raising the index-driven NAV by achieving the goals of the ECC Bond. Such opportunities occur when ECC Bonds are traded at NAVs significantly in excess of their intrinsic, formula-driven value.)

(In turn, Gold-based monetization - the issue of Cause-based incremental liquidity, M2dot, either as IMF-sponsored Sustainability Gold ETFs, or WB CC-Innovation Dollars upon physical gold submitted toward, and held in lien for the monetization - creates fresh capital that furthers the cause of the Real economy – appropriate for a society that has a natural proclivity to lurch toward a nominal, even an unsustainable economy. The monetization involves varying the ratio of Gold ETFs issued against physical Gold with the measured severity or significance of the Cause (as registered via the Ballot/Referendums/Surveys or other information/opportunity-imbued instruments such as Compcoins) through a novel financial construct, the 'Futcoin delta' that, in turn, derives from Futcoins, an FV unit of NAV linked to index-driven Global Cause Bonds. The more significant the Cause, the larger is the Sustainability- or Innovation-deficit/opportunity, the larger is the Futcoin delta associated with the instrument, and the more Sustainability/Innovation capital it deserves. A Gold-based, Cause-dependent monetization, tied to the magnitude of 'Futcoin Delta' for calibration, ensures the supply of Sustainability- and Innovation capital in the right amounts.........

The FII post-dated P-Notes offered to the Planning Commission are themselves sourced from an 'Unsustainability Mirror-Incremental Multiple-EO Round' from a future series of FII-sponsored gold-monetization at the IMF/WB, and expressly intend to resolve current unsustainability in the nation, reflected in ECC Bonds and Compcoins, against anticipated unsustainability elsewhere in the group of gold-monetizing nations.

This exchange of the Bond EATV corpus against the post-dated P-notes leaves untouched the Bond units assigned to the SB:SJ:CP:EI, who turn de-facto 'FII Cause Judges'. Cause Judges monitor FII diligences, including their political conduct, during the course of the bond duration. By their pronouncements and market moves, they signal and determine the pace of progress in the Bond Cause. They also have a final say in the export of Compcoins toward use in Gold monetization at the IMF/WB.